Assume Purchase Costs Are Rising Determinee Which of the Following

Cost of goods sold was calculated to be 7200 which should be recorded as an expense. FIFO produces a lower amount for net income than LIFOd.

Ending Inventory Formula Step By Step Calculation Examples

When purchase prices are rising which of the following statements is truea.

. Your Answer incorrect Assuming purchase costs are rising in a periodic inventory system determine which of the statements below arecorrectregarding the cost of goods sold under FIFO LIFO andweighted average cost flow methods. During the period It sold 14. Assume that Widgets Inc.

The physical count is used to determine if there has been any theft loss damage or errors in inventory. Companies using FIFO will report the smallest cost of goods sold. During the period it sold 4 units from beginning inventory 8 units from the Jan.

FIFO produces a lower amount for net income than LIFO. Companies using FIFO will report the highest gross profit and net income. 5 purchase and 2 units from the Jan.

FIFO produces a lower amount for net income than LIFOd. New average 180189 36924 units 15375 per unit. The physical count is used to determine if management needs to reassign sales responsibilities.

Assuming purchase costs are rising in a periodic inventory system determine which of the statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methods. LIFO produces a higher cost of goods sold than FIFO. Cornerstones of Financial Accounting 4th Edition Edit edition Solutions for Chapter 6 Problem 9MCQ.

Assuming purchase costs are rising in a periodic. When purchase prices are rising which of the following statements is truea. Cornerstones of Financial Accounting 2nd Edition Edit edition Solutions for Chapter 6 Problem 9MCE.

Given the following information determine the cost of goods sold for the period. Answer to Evaluating the LIFO and FIFO Choice When Costs Are Rising. Uses a perpetual specific identification inventory system.

Assume that J-Mart uses a perpetual weighted average Inventory system. June 1 at 10 June 2 at 15 July 4 at 20 The company sells two units during the period. LIFO produces a higher cost of goods sold than FIFOb.

QUIZ 2 Multiple-Choice Exercise 6-9 When purchase prices are rising which of the following statements is true. When purchase prices are rising which of the following statements is truea. Assuming purchase costs are rising in a periodic inventory system determine which of the statements below are correct regarding the cost of goods sold under FICO LIFO and weighted cost flow methods.

Determine which of the following statements are correct regarding the difference between physical flow and the cost flow of inventory. LIFO produces a higher cost of goods sold than FIFOb. Companies using FIFO will report the highest gross profit and net income.

Solutions for Chapter 6 Problem 9MCQ. Assume that three identical units are purchased separately on the following three dates and at the respective costs. Jan 1 Beginning Inventory 950 Jan 1-30.

LIFO produces a higher cost for ending inventory than FIFOc. Companies using FIFO will report the highest gross profit and net income. Check all that apply 2.

April 1 Beginning Merchandise Inventory 10 units 15 each 3 7 units sold 10 Purchased 9 units at 16 23 4 units sold Determine the Cost of Goods Sold using the LIFO inventory costing method and the periodic inventory system on April 30. FIFO produces a lower amount for net income than LIFOd. With the lower for longer interest rate environment and rising costs of technology investments we believe already rising US.

Determine which of the following statements is correct regarding the. Declining An inventory error not only affects the current years cost of goods sold gross profit net income current assets and equity but also the next periods statements because. During the period it had two sales.

Check all that apply Correct Answer Companies using FIFO will report the highest gross profit and net income. LIFO produces a higher cost for ending inventory than FIFOc. June 1 at 10 June 2 at 15 July 4 at 20 The company sells two units during the period.

June 1 at 10 June 2 at 15 July 4 at 20 The company sells two units during the period. Assuming purchase costs are rising in a periodic inventory system determine which of the statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methods. Many companies choose to use LIFO inventory costing during periods of rising purchase costs because reported cost of goods sold will be highest lowesVhighest.

Assuming purchase costs are rising determine which of the statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methodsA. During a period of regularly rising purchase costs this method yields the highest reported cost of goods sold amount on the income statement. Assuming purchase costs are rising determine which statements below are correct regarding the cost of goods sold under FIFO LIFO and weighted average cost flow methods.

LIFO produces a higher cost for ending inventory than FIFOc. Average cost produces a higher net income than FIFO or LIFO. Assume that Wally World uses a periodic weighted average inventory system.

LIFO produces a higher cost of goods sold than FIFOb. Assume that three identical units are purchased separately on the following three dates and at the respective costs. Given the following information determine the cost of goods sold for the period.

When purchase costs are risingdeclining LIFO will report the lowest cost of goods sold yielding the highest gross profit and net income. Assume that three identical units are purchased separately on the following three dates and at the respective costs. Purchased 10 x 18 180 on 628.

The physical count is used to determine if customers are paying within the discount period. LIFO produces a higher cost for ending inventory than FIFO. Conclude which inventory items are sold first and which unit remains in ending inventory if the company is using the LIFO perpetual cost flow assumption.

Assume the following beginning inventory purchases and sales during the month of April. Average cost produces a higher net income than FIFO or LIFO.

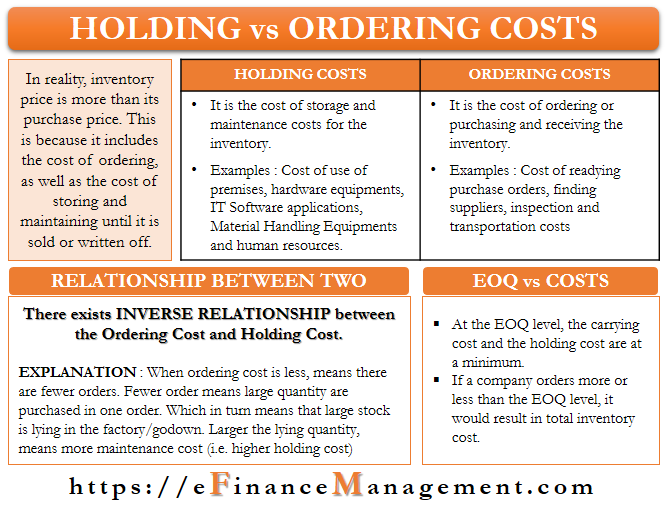

Holding Cost Vs Ordering Cost All You Need To Know

What Is The Fifo Method Calculations Examples Impact Quickbooks

Inventory And Cost Of Goods Sold Quiz And Test Accountingcoach

/MinimumEfficientScaleMES2-c9372fffba0a4a1ab4ab0175600afdb6.png)

Comments

Post a Comment